How to take money to Buenos Aires? Many people have doubts regarding Currency in Argentina: cash, blue dollar or card?

Traveling to Argentina can be an enriching experience in several aspects, including cultural, gastronomic and, of course, financial. During my stay, I was able to see how the exchange rate issue directly impacts tourists’ pockets. The first observation is that “you really get rich in Argentina!”

In this article I will explain the main details about Currency in Argentina: what the blue exchange rate is, which currency to take to Buenos Aires, which card to take and much more!

Currency in Argentina: cash, blue dollar or card?

How the Exchange works in Argentina

The dollar plays a crucial role in the Argentine economy, being used by Argentines for savings, real estate transactions and even to preserve the purchasing power of their salaries throughout the month. However, due to legal restrictions, ordinary citizens cannot purchase dollars at the official exchange rate, resulting in a significant demand for dollars on the parallel exchange rate, known as the blue exchange rate.

What is the blue exchange rate in Argentina?

This is the parallel exchange rate that ended up “becoming official” for the currency in Argentina and is used by tourists. It is called the blue dollar or real blue and normally pays twice the official exchange rate. When I visited Buenos Aires the price was 150 pesos to 1 real. If it were the “real official” it would be 75 pesos. Look at the difference!

During my stay, I noticed variations in exchange rates in different regions. While in Buenos Aires the exchange rate was quoted at 150 pesos to 1 real, in Puerto Iguazu and Posadas, for example, the value was 190 pesos. These are values for November 2023 and can fluctuate a lot due to Argentina’s economy. Probably in Argentine Patagonia and Ushuaia there will be other values.

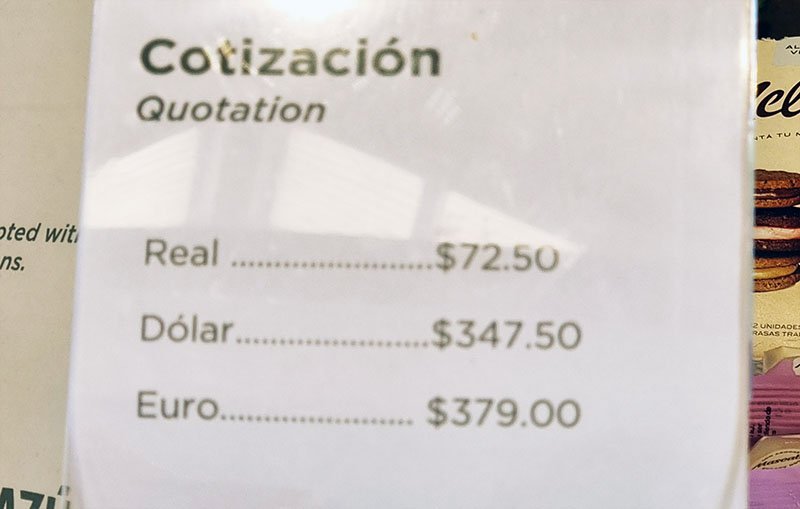

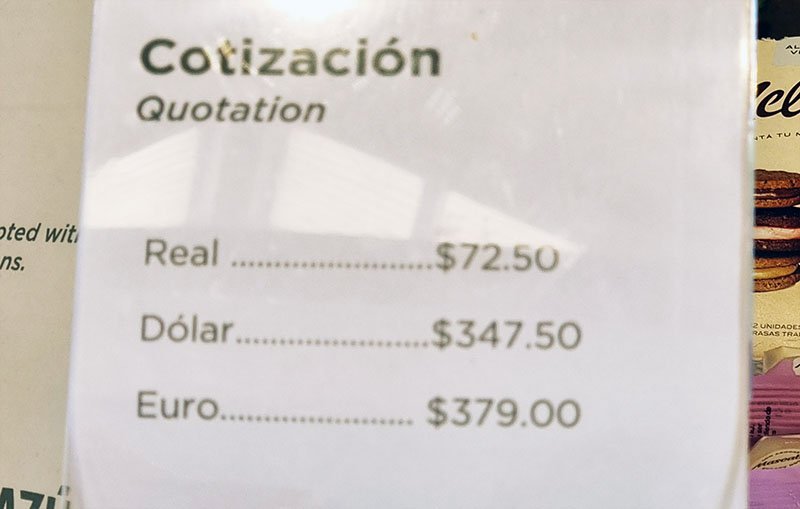

Some stores can even exchange currency on the spot, accepting other currencies, however you don’t always have an advantage. Look at the prices charged for Currency in Argentina in stores inside Parque das Cataratas in Puerto Iguazu:

Types of exchange in Argentina

In addition to the blue exchange rate, there are other exchange rates created by the government to serve specific sectors, such as finance, agribusiness, exporters and tourism. Argentina has different types of exchange rates, see a summary of each one:

- Official Exchange Rate: The exchange rate is established by the government, artificially valuing the peso. This appears when you convert using Google, for example.

- Blue Exchange: this is the parallel exchange rate that ended up “becoming official”. This is used by tourists and practiced in exchange offices in the country called blue dollar or real blue. Normally you pay double the official exchange rate.

- MEP exchange rate (Electronic Payments Market): Established by the government for the financial market, the MEP exchange rate tends to follow the variation of the blue exchange rate.

- Tarjeta Exchange Rate: differentiated exchange rate for transactions with credit and debit cards issued outside Argentina. Quotes are slightly lower than the MEP dollar. VISA cards make the transaction using this exchange rate, while Mastercard makes the quote and takes a few days to return the remainder (then you need a higher limit on the card).

Currency in Argentina: types of banknotes

When you pick up Argentine peso bills, you will notice that most of them are 1000 peso bills. It’s rare to find the 2000 one. During my trip, I found several different designs of currency notes in Argentina, see the photo below.

How to exchange real for Argentine peso

The main tip is: do not exchange reais for Argentine pesos at exchange offices in Brazil because you will get a better rate as soon as you arrive in Argentina. First expenses such as hotel, dinner, etc. can be paid using the card itself.

To give you an idea of the current exchange rate in Argentina, you can view the real blue on the CUEX website.

There are some ways to exchange reais for currency in Argentina, in addition to the differences between international debit and credit cards. Check out the advantages and disadvantages below!

Western Union in Argentina: how it works

The most common way to exchange currency in Argentina is through Western Union, where you transfer in pix to reais and can withdraw the amount in Argentine pesos at agencies accredited by the country. The site is very easy to use, but the problem is withdrawing the money there.

I had problems with this option because the agencies were out of money on Saturday and the system doesn’t work on Sundays. Monday was also a holiday. This alternative is more viable for those who intend to stay for a longer period of time or arrive during the week.

I made two transfers of R$400 and was only able to withdraw it late in the afternoon on Monday, as I was leaving on Wednesday morning.

✅ Advantages:

Use blue dollar

Transfer online by paying in pix

You can buy weight on site

❌Disadvantages:

Queues to withdraw money

Open only on weekdays after 10am

There may be a lack of money during holidays and at the end of the year

Giant wad of bills in wallet

Wise Card in Argentina: how it works

My arrival in Argentina was scheduled at night and because it was a Saturday, which limited conventional exchange options. Given this situation, I chose to use the Wise international debit card, a choice that turned out to be quite positive. For those unfamiliar, Wise offers a multi-currency account with an international card that works in several countries. I use it directly in Europe!

As I already had euros and pounds sterling in my account because I live in Europe, Wise does the conversion automatically, eliminating the need to purchase weights through the app. The multicurrency account provided flexibility and practicality, meeting needs in everyday situations and offering an efficient alternative in places that only accept card payments.

My Wise card worked everywhere like restaurants, stores and online attractions like Teatro Colon. In fact, it was a convenient solution at the Recoleta Cemetery, where payment is only accepted by card. Every time he used the card exchange rate (he charged half the official exchange rate).

However, it is important to highlight that there were some limitations, such as the non-acceptance of Uber payments for more distant rides, above 2 thousand pesos. Despite this small setback, overall, I think choosing Wise was worth it.

✅ Advantages:

Payment using card exchange

Automatic peso to dollar conversion

Don’t carry a wad of cash in your wallet

No need to buy Argentine pesos (just have dollars or euros in your account)

❌Disadvantages:

Not accepted on the Uber app for longer rides

Some cards issued in Brazil may not work everywhere

Remember to always ask to pay in Argentine pesos at the machine, do not accept in dollars!

With the Wise account you can receive money from several countries and use the card to travel throughout Europe! Wise’s international debit card is free and works in more than 160 countries!

Credit card in Argentina

As I mentioned previously, the Argentine government implemented the tarjeta exchange rate, which is slightly below the MEP and more or less follows the fluctuation of the blue dollar. However, purchasing Argentine Currency on the card comes at a disadvantage, sometimes reaching 20% below the blue.

However, it is a good idea to take an international credit card to Argentina in case you have problems with other payment methods. You can pay for your hotel reservation with an international card because most hotels discount the 21% VAT and the price is almost the same as using Blue.

You can also purchase tickets and tours such as Teatro Colón. Remember that in addition to the card exchange, there is also the Tax on Financial Operations (IOF).

You can also see the exchange rate on the Visa website.

✅ Advantages:

Pay first expenses

Accumulate points/miles

Security if you have problems

Visa card charges the exchange rate instantly

❌ Disadvantages:

Pays a little more than the blue dollar

IOF higher than international debit card

Mastercard can charge the full amount and then refund 50%, you need a higher limit

Sometimes you need to call the bank to collect the correct exchange rate.

Exchange from real to peso in Cuevas

The cuevas are parallel exchange offices, those hidden in the streets, mainly on Calle Florida. In these places you can even negotiate the price, but you need to be careful with fake currency notes in Argentina.

Follower Florencia lived in Argentina and recommends these places in the center of Buenos Aires: Avenida Corrientes 3887 Turismo Agencia and the caves of the Gallery 200m from Lavalle. In Recoleta is the Cambio La Plata and Vicente López, 1825.

✅ Advantages:

You can negotiate and get better currency quotes in Argentina

❌ Disadvantages:

Don’t know exactly where to change

You can be cheated on the amount of notes or receive fake notes

How to get the best exchange rate in Argentina

In summary, when planning a trip to Argentina, it is crucial to consider the exchange options available and choose payment methods that suit your profile and the length of your stay. The currency in Argentina fluctuates a lot, as the economy is not doing very well.

Check the quote and make smaller remittances like R$400 via WU (I took 800, I think it’s enough to eat for about 3 days without accommodation, I bought some clothes too). Prefer to arrive during the week to be able to withdraw your money smoothly.

Avoid setbacks by using an international debit card like the Wise card. You don’t need to buy Argentine currency in the app, you can have a stronger currency with the dollar or euro. If you have difficulty using it, you can withdraw Argentine pesos from any ATM machine.

Only use your credit card at the beginning of your trip and as a reservation.

In the video below I explain more details about the Currency in Argentina and more travel tips, click to watch:

Did you like this information about Currency in Argentina and exchange rate?